Samsung and Apple are thriving and making strides in a global market that shrank 11% in 2022. Xiaomi, Oppo and Vivo, their top 5 competitors, are all lagging behind.

Which companies could sell the most in the smartphone market in 2022? There is no big surprise. The three winners are the same as last year, according to analytics firm Canalys, which bases its findings on the number of phones shipped from factories worldwide. The top 3 are Samsung, Apple and Xiaomi. Then we have Oppo and Vivo completing the top 5.

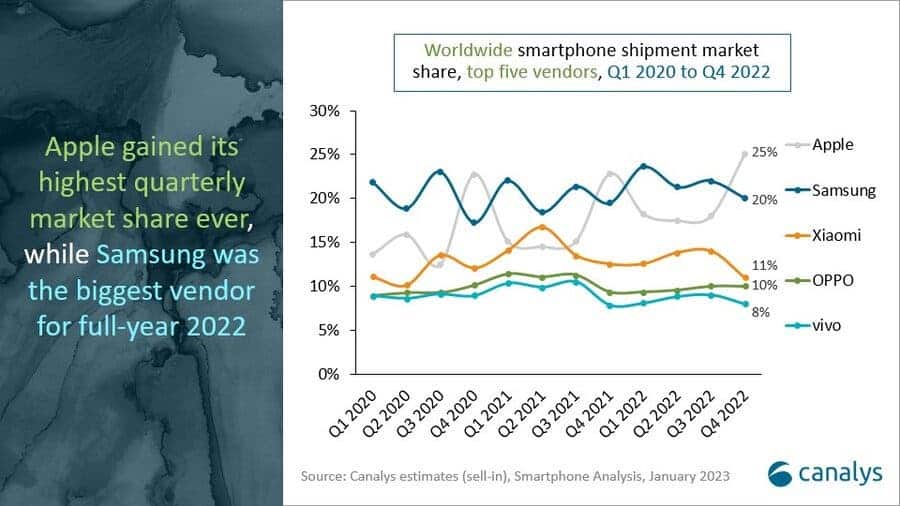

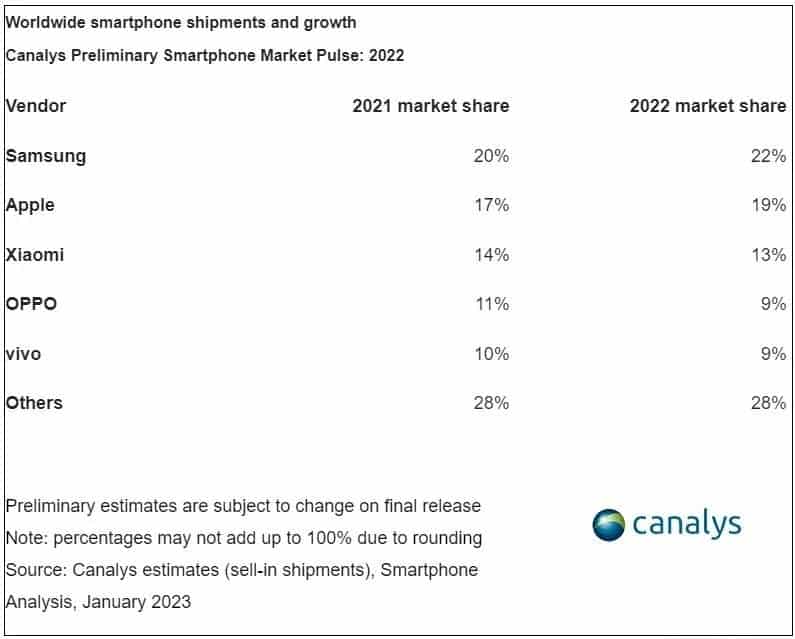

When the rankings haven’t changed, the numbers show that the top two consistently dominate. Samsung jumps from 20% to 22% and Apple from 17% to 19%, while Xiaomi falls from 14% to 13% and Oppo and Vivo fall to 9% of global sales.

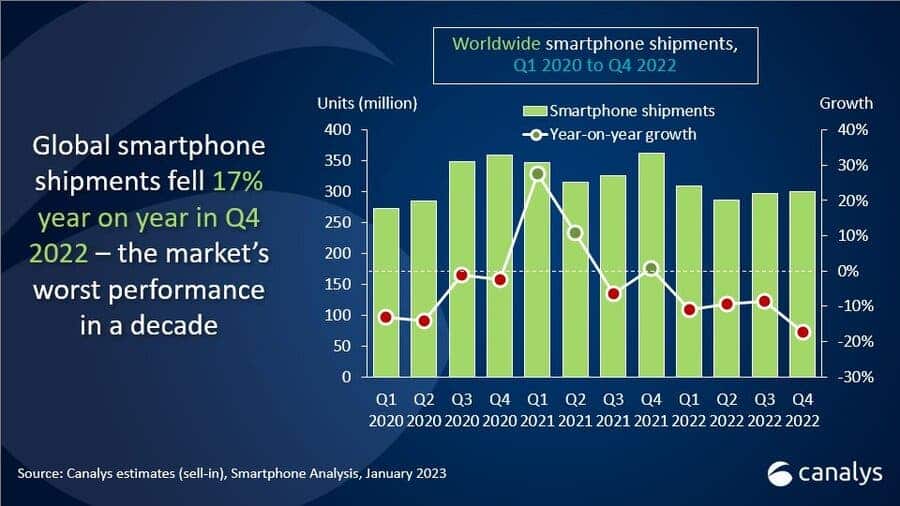

It would be easy to assume that the two giants at the top would have won everything, but the situation is more complicated. In 2022, smartphone shipments fell drastically by 11% to less than 1.2 billion.

Recent Articles

Apple is the undeniable champion of the fourth quarter

Given that the iPhone release schedule has made it widely known that Apple often leads the fourth quarter, it should also be stressed that Apple is having an exceptional year-end. With 23% market share in 2020 and 2021, the Apple brand ended up taking the top spot that year with 25% of sales.

In the fourth quarter, Samsung went from 19% to 20% and continued its upward trend, similar to Oppo, which landed at number four and improved from 9% to 10%. Vivo still has 8% of sales, while Xiaomi is a close third with 11%.

How can such performances be explained?

Some would be inclined to immediately attribute this decline to the brands’ lack of creativity, while analytical companies blame a complex economic environment for it. “In a tough macro environment in 2022, smartphone vendors struggled. The fourth quarter represents the worst annual and quarterly results in a decade,” said Runar Bjrhovde, analyst at Canalys. According to the company, 2023 will be just as challenging.

“The distribution channel is very cautious about adding new inventory, which contributes to low shipments in the fourth quarter. Supported by strong promotional incentives from vendors and channels, the holiday season helped reduce inventories. While demand in the low- to mid-range segment declined rapidly in previous quarters, demand in the high-end segment began to show weakness in the fourth quarter. Market performance in Q4 2022 is in stark contrast to Q4 2021 where demand increased and supply issues abated.”

Who sold the most smartphones in 2022?

Gizchina News of the week

The smartphone market as a whole is struggling. However, not everyone experiences this breakdown as quickly as others. Vivo, Xiaomi and Oppo are all experiencing sharp declines, but Samsung and Apple are maintaining their sales despite the crisis.

The smartphone market has stalled a bit in 2022, falling 11%. At least that’s according to research firm Canalys, which tracks manufacturers’ smartphone shipments, a reliable indicator of global sales volume.

They claim that 1.2 billion phones have been sold worldwide. Additionally, we can easily estimate the number of phones sold by Samsung, Apple, Xiaomi, Oppo, and Vivo as the company also provides the top 5 market shares over the year.

“Vendors will approach 2023 cautiously, prioritizing profitability and protecting market share,” said Canalys Research Analyst Le Xuan Chiew. “Vendors are cutting costs to adapt to the new market reality. Building strong partnerships with the distribution channel will be important to protect market share as difficult market conditions can easily result in strenuous negotiations for both channel partners and vendors.”

How many smartphones were sold by the top 5

Keep in mind that these are estimates, particularly as Canalys takes pride in occasionally rounding up and down to show percentages. Here is the result of the calculation:

- Samsung: around 264 million (22%);

- Apple: around 228 million (19%);

- Xiaomi: around 156 million (13%);

- Oppo: around 108 million (9%).

- Vivo: around 108 million (9%).

Here’s what it compares to 2021, when 1.35 billion smartphones were sold, according to Canalys:

- Samsung: around 274.5 million (20%);

- Apple: around 230.1 million (17%);

- Xiaomi: around 191.2 million (14%);

- Oppo: around 145.1 million (11%);

- Vivo: approximately 129.9 million (10%).

“Although inflationary pressures will gradually ease, the impact of interest rate hikes, economic slowdown and an increasingly troubled labor market will limit market potential,” he added Khiev. “This will adversely affect mature, mid- to high-end dominated markets such as Western Europe and North America. While China’s reopening will improve domestic consumer and business confidence, government stimulus is not expected to take effect for six to nine months and demand in China will remain difficult in the near term. Still, some regions are expected to grow in the second half of 2023, with Southeast Asia in particular expected to see some economic recovery and tourism resurgence in China, which will boost business activity.”

Chinese brands are facing significant losses

It is therefore clear that all top 5 brands are affected by the drop in sales. Not everyone is equally affected. Apple lost 0.91% and Samsung lost 3.83%. While the percentages for Xiaomi, Oppo and Vivo are 18.41% loss for Xiaomi, 16.86% for Vivo and 25.57% drop for Oppo, the latter is the worst loser in history.

These figures undoubtedly explain the regression of Chinese manufacturers in 2022, which has often prevented them from launching numerous models on the global market, a problem that particularly affects the models that serve as benchmarks for the brands. As examples we can cite the unreleased Xiaomi 12S Ultra, Oppo Find N and Vivo X90.